The financial world is driven by data, and traditional sources have included company filings, press releases, analyst reports, and other structured data that is typically stored in spreadsheets or relational databases. More recently, investors, analysts, and businesses have turned to unconventional, or alternative sources of data to gain insights and inform decisions. So, what is alternative data, where is it found, and how is it being used?

Alternative data is any type of data that comes from a variety of unstructured and nontraditional sources. It is often publicly available and can also be purchased from specialized providers. When analyzed, alternative data has the potential to provide new perspectives on economic trends, company performance, and consumer behavior. Alternative data has moved into the mainstream, especially given the competitive nature and transaction speed of the investment sector.

What are sources of alternative data?

Common sources include:

- Social media — Sentiment analysis from social media platforms can reveal public opinion about companies or products

- Web traffic — Website visitor patterns can indicate the popularity of a company or product before earnings are reported

- Web scraping — Data collectors use web scraping scripts to mine publicly available information from websites

- Consumer transactions — This powerful data captures detailed purchasing activities, offering early indicators into revenue growth and earnings

- Satellite imagery — Images of parking lots, construction sites, agricultural fields, and the aftereffects of natural disasters can be used to track retail visits, booming locations, crop yields, and damages

- App usage — Data from mobile app downloads and usage reveals interest and engagement with digital products

- Private jet data — Aviation movements could be indicative of deal-making in progress

- Shipping and logistics data — Shipment tracking and supply chain activity offers insight into a company's operations

- Internet of Things (IoT) — The data generated by the millions of IoT devices can illuminate trends and patterns

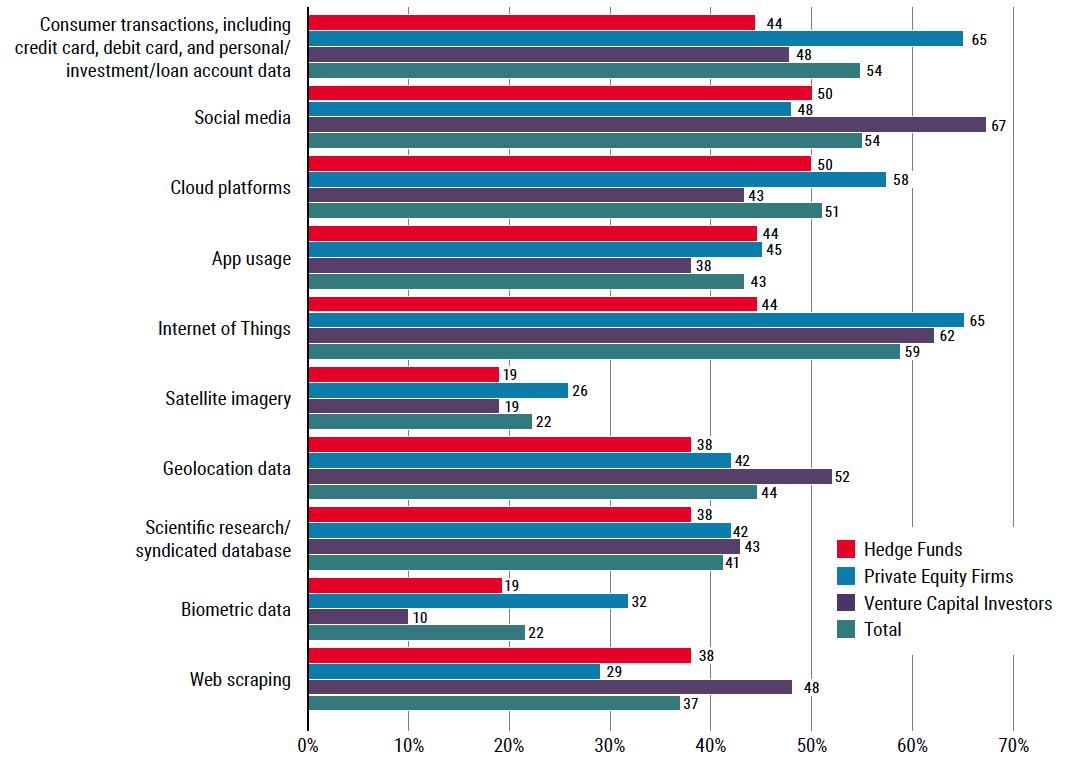

In a survey conducted by Lowenstein Sandler’s Investment Management Group, they asked respondents “What are your sources of alternative data?” Consumer transaction, IoT, and social media were the clear leaders for where investors are looking for the most valuable alternative data.

How is alternative data used?

Alternative data was initially used mostly by hedge fund managers, but it has rapidly become a fixture in all types of investment firms and large corporations. It has also given rise to organizations that specialize in collecting and selling data that has been pre-processed and cleansed for analysis. Once alternative data has been analyzed, it can be used for a variety of purposes:

Investment Decisions — Hedge funds, asset managers, and institutional investors use alternative data to get a competitive edge when it comes to predicting company performance and the movement of the stock market.

Risk Management — By analyzing shipping data and weather patterns, businesses can identify risks in their supply chains. Similarly, unusual patterns in transaction data can help detect fraud or irregularities.

Market Research and Consumer Insights — Companies use alternative data to understand consumer behavior, preferences, and trends. This is helpful for product development, marketing strategies, and customer engagement.

Corporate Strategy — Firms use data from competitors, such as web traffic or social sentiment, to gauge their performance relative to the established market, for pricing and marketing strategies, and for evaluating market entry strategies or expansion opportunities.

Real Estate — Geolocation data and satellite imagery are used by real estate investors to assess economic activity, monitor development projects, and gauge property values.

Economic Forecasting — Economists and policymakers use alternative data along with traditional sources to track economic indicators, like employment trends and consumer confidence.

Alternative data and AI

With big data comes the need to streamline and automate analysis. Nothing is better equipped to tackle alternative data than artificial intelligence (AI) and the advanced processing capabilities that can rapidly glean insights from huge volumes of input.

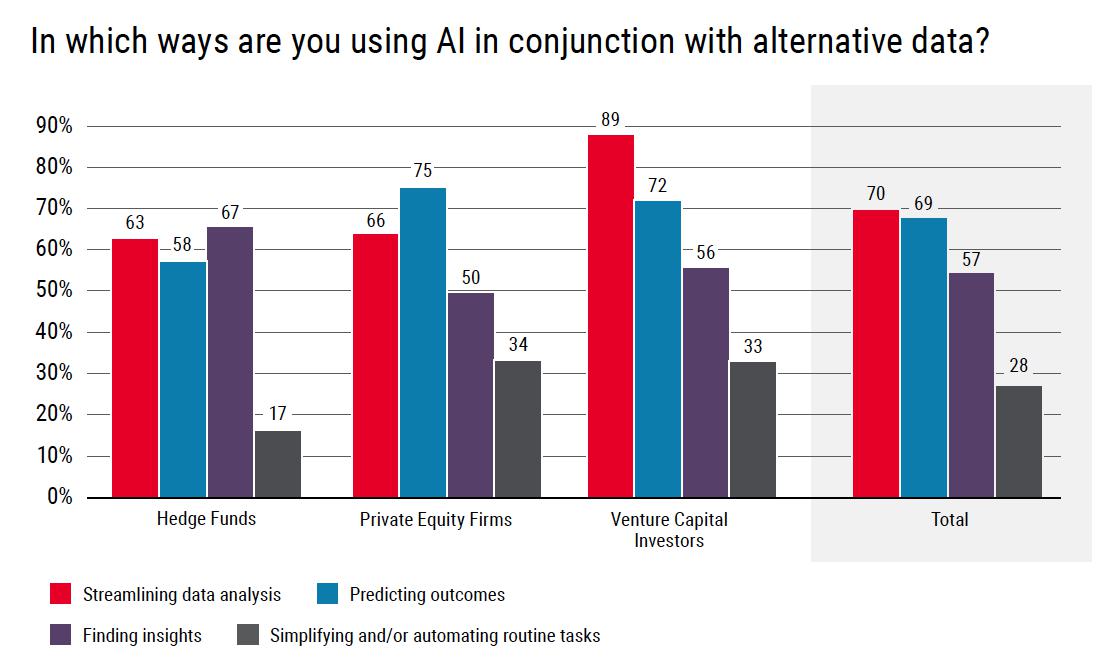

In the previously mentioned Lowenstein Sandler survey, they asked respondents “In which ways are you using AI in conjunction with alternative data?” The results are telling as the majority indicate they use AI to streamline data analysis, predict outcomes, and find insights.

AI and natural language processing (NLP) can make short work of the computational requirements for gleaning insights from unstructured text. NLP algorithms help with understanding human language, entity resolution and event extraction, and converting unstructured data into usable formats. AI can also analyze visual inputs, such as satellite imagery, drone footage, or security camera feeds.

The machine learning (ML) models that underpin AI are trained on large datasets to identify patterns that are otherwise difficult for humans to detect. These patterns could relate to consumer behavior, stock trends, supply chain disruptions, or climate impacts. The same algorithms that detect patterns can also detect anomalies in those patterns that may indicate market shifts, business risks, or investment opportunities.

AI-powered sentiment analysis can assess public mood or perception about a company, product, or market by analyzing text from social media, reviews, and news. This helps investors, marketers, and business leaders gauge public sentiment and forecast market movements or consumer behavior.

Stock trades can now be executed in milliseconds, and it only takes a few minutes for the markets to react to current events. AI can process massive streams of alternative data in real-time, offering actionable insights for quick investment decisions. Investors can use AI to create quantitative models that may identify potential market inefficiencies, emerging risks, fraud, and suspicious activities in real-time.

Advantages of using AI for alternative data

When microseconds matter, investors must use every advantage at their disposal to make the smartest decisions possible. AI processing of alternative data can offer these benefits:

- Speed — AI can process large and diverse datasets at a scale and speed that humans cannot, providing real-time insights.

- Accuracy — Machine learning models can identify hidden correlations, trends, and anomalies more accurately than traditional analysis methods.

- Scalability — Investors and businesses can handle increasing volumes of data, while honing predictive models.

- Usability — AI provides structure and the ability to connect disparate data sets in meaningful ways

- Cost-Effectiveness — AI-driven data analysis cuts operational costs while improving decision-making capabilities.

The combination of AI with alternative datasets enables businesses and investors to make better-informed decisions, uncover hidden opportunities, and mitigate risks faster and more effectively than traditional methods.